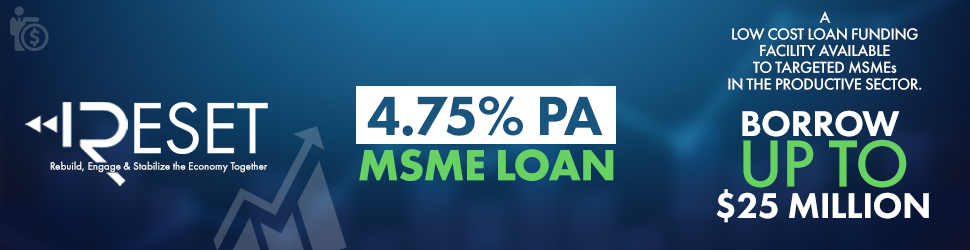

Reset Loan

What is a Reset Loan?

A low-cost loan funding facility available to MSME’s in the productive sector, to help reset and re-engage your business due to the COVID-19 Pandemic. EXIM’s Reset Loan is offered over both the short and medium term, as a revolving or non-revolving loan facility with and interest rate of 4.75% per annum and a processing to disbursement time of 20-25 working days, if all conditions are met.

Eligible Projects

- Working capital (raw material acquisition, market access, receivables financing, operating expenses etc.)

- Capital expansion (equipment, plant upgrade, etc.)

- Technology upgrade, ICT design and implementation

Eligible Borrowers

- Agriculture

- Manufacturing (including Agro-Processing)

- Catering & Restaurants

- Selected Services

- Tourism Linkages

How to Apply

To start your application, you may click the links below and complete each forms. You will be required to provide the following documents:

- Incorporating/Registration Documents

- 2 Valid Identification

- Copy of Company’s Tax Compliance Certificate

- Proof of Address

Please complete the following forms by clicking and completing. Please note: Forms 1-3 below will need to be downloaded and completed using Adobe. Sign and save copies of each and return to our email address. Forms are editable using Adobe.